Space has always been the dark, mystifying void, familiar to

the common man only through text books and documentaries. Practically, yet,

ironically, space or the universe as a whole does not seem to affect the humble

humans living on Earth. Its traverses are limited only to tabloids, scientists

or the weekly documentary on the discovery channel. Until now, the space

industry was mainly driven by the state funding to their respective national

space agencies.

However, this arrangement is rapidly changing with the

private sector taking a keen interest in space innovation (A déjà-vu moment for

Sci-Fi buffs). But space is not your ordinary run-of-the-mill industry with

initial investment and long term profits. Investment in space is a continual and

painstakingly grueling process, with the silver lining of profits far away into

the distant future.

The space shuttle program of the United States officially

came to an end in 2011. This led to the United States having to rely on other

space agencies and mediums to launch supplies in order to keep the

International Space Station operational. However, this was still not feasible

as the only other reliable country with an autonomous launch vehicle was

Russia.

The gradual development of these events breathed fresh life

into the Elon Musk founded company SpaceX. The company successfully test fired

their rocket and launch vehicle systems in the presence of NASA scientists;

thus, bagging a $1.5 billion contract for providing essential supplies to the

space station for the next couple of years. This was a huge achievement for the virtually

unexplored industry and led to the opening of a new frontier for business.

According to 2013 estimates, the space innovation industry

is currently valued at 315 billion dollars, consistently growing at around 4

percent per annum. The tremendous growth tasted by SpaceX has prompted

entrepreneurs to latch on the early opportunity as the industry is expected to

double in the next ten years; an opportunity that is too tempting to resist.

This newfound faith in exploring space has prompted

entrepreneurs to engage in bold and what some may term as foolhardy measures to

develop space technologies ranging from rockets and spaceships to asteroid

miners, Moon Landers, interplanetary transport vehicles and zero gravity 3-D

printers. This is not some stuff out of a science fiction novel; these are

actual technologies being developed by the so-called next-gen start-ups.

This industry has another dimension; a more fun and

luxurious dimension. Richard Branson founded Virgin Galactic and other small

companies in the fray are offering trips to space to patrons. However, the ticket

to space goes at $200,000 a pop. But, the company hopes to provide the ‘joy of

space travel’ accessible to the common man in subsequent years.

The commercially successful industries here on Earth, are

fueling the progress for space innovation. The glowing examples of this growth

are companies like Boeing and SpaceX; whose successful business models are

enabling the reallocation of resources. The common man may think that space

exploration and travel is only a rich guy’s whim, but the same thing happened

with the aviation industry, which was inappropriately disregarded as an

extravagant dream of playboys.

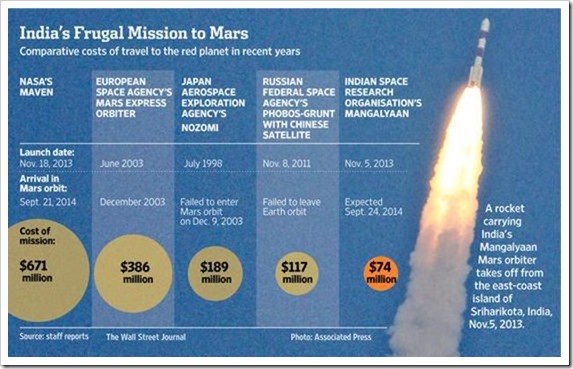

India’s recent space missions to the Moon and Mars were not

mainly in the spirit of science, but had an ulterior motive of emblazoning its

low cost, yet, effective technology to the world. The growth of this industry

will suffer form shortfalls unless newer and more efficient technologies can be

developed. India’s move to showcase their low cost rocket technology will go

further to bolster investment in India’s space program initiatives.

For now, the real business of space is just about promoting

science and providing much needed ground support to keep the International

Space Station operational. However, this is because the control of the industry

is in a phase of transition from government hands to those of corporate. Once

the base is ready, the private sector will look to fully exploit the

opportunities that lay in space, encompassing the tertiary services right at

home.

But, there have been recent setbacks to the industry, which

have opened it up for debate, whether space companies will ever be able to

bring home the bacon. Orbital Sciences’ Antares rocket, carrying cargo supplies

for the space station exploded shortly after take-off. In another incident,

Virgin Galactic’s SpaceShip Two crashed, killing its test pilot. Such setbacks

are foreseeable, given the nature of danger that follows with the line of work.

The advancements that will be made after such setbacks are much more important

as they will be reminiscent of the growth and maturation which will take space

innovation to its heights.

Private investment will keep on growing as the achievements

and success of companies will invite more and more to join in on the space

boom. The first space race ended with the end of the Cold War, but a whole new

space age is taking shape right before our eyes. The coming years will be a

testament to how well the industry is able to mature and grow from its infancy

in achieving the visions of its pioneers. You may very well be enjoying a

burger from McDonalds while sipping a hot latte at a vacation in space.